Understanding Die vs Package Correlation

A Practical, Business-Critical Guide for Modern Semiconductor Teams

In semiconductor manufacturing, truth hides in the details. A chip can look perfect on the wafer. Then it fails in the package. Or worse—it passes everything and dies in the field.

That gap is where die vs package correlation lives.

As the old engineering proverb says:

“What you don’t measure, you can’t control.” — Peter Drucker

This article explains what die vs package correlation really means, why it matters, and how leading teams use it to reduce risk, cost, and time-to-market.

1. Fundamentals: Die, Package, and Manufacturing Context

Description: This section builds a shared foundation by clarifying what a die is, what a package does, and where correlation is created—or lost—across the semiconductor lifecycle.

A die is the raw silicon. It holds transistors, memory, logic, and IP. The die defines capability: speed, power, leakage, and function.

A package is the protective and connective shell. It defines usability: thermal dissipation, mechanical strength, signal integrity, and reliability.

They serve different purposes. But they are inseparable.

Where correlation is introduced—and broken

Correlation begins at wafer probe, continues through assembly, and is tested at final test. It often breaks during hand-offs:

- Fab → OSAT

- OSAT → Test

- Test → System integration

Each step adds noise. Each data gap hides truth.

Key insight:

A good die in a bad package is still a bad product.

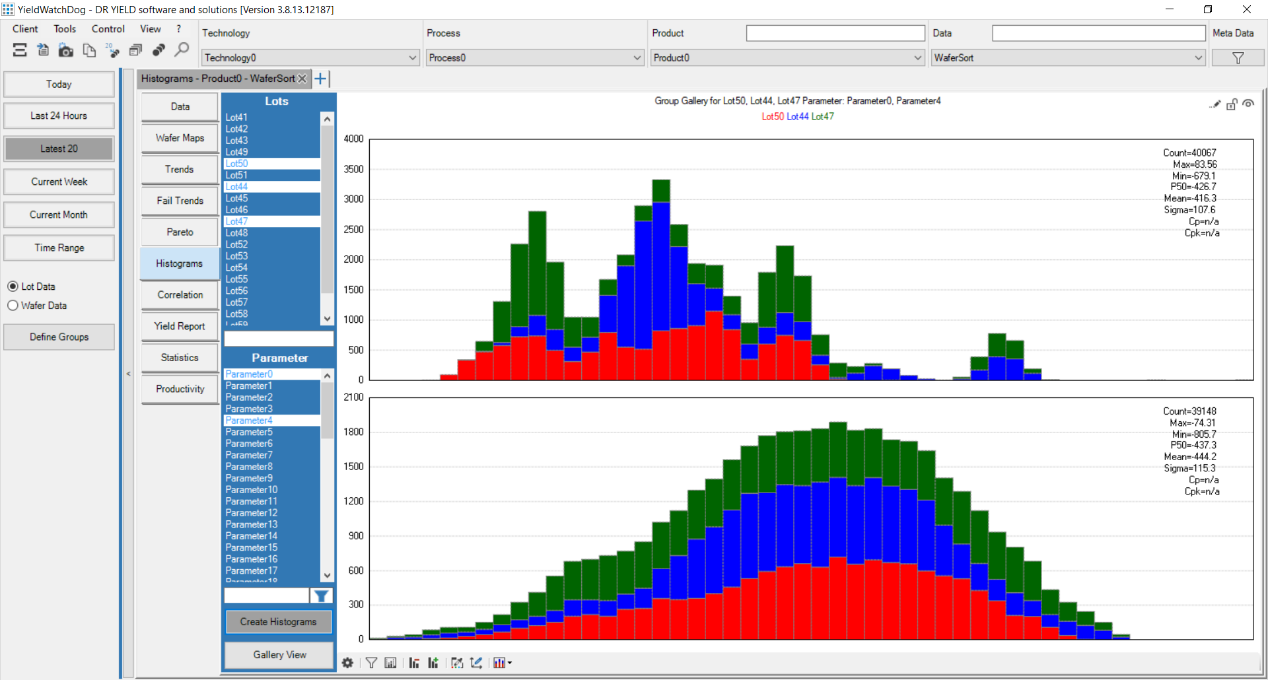

2. What Is Die vs Package Correlation?

Description: This section defines die vs package correlation in practical terms and explains how it enables true root-cause analysis.

Die vs package correlation is the ability to link die-level data (wafer location, parametrics, defect signatures) to package-level outcomes (yield loss, failures, reliability issues).

It answers hard questions:

- Did this failure start on silicon—or during assembly?

- Is yield loss random—or location-based?

- Is a supplier masking a real problem?

Typical correlation metrics

| Data Layer | Examples |

|---|---|

| Die-level | Wafer ID, X/Y location, leakage, Vmin |

| Package-level | Warpage, opens/shorts, thermal failures |

| System-level | Field returns, RMA patterns |

Common false correlations

- Blaming assembly for weak die

- Blaming die when packaging stress is the trigger

- Averaging data until patterns disappear

Warning:

Correlation without context creates confidence—but not truth.

3. Why Die vs Package Correlation Matters to Performance and Business Outcomes

Description: This section connects technical correlation to yield, cost, reliability, and executive-level decisions.

Correlation is not academic. It is financial.

Performance and yield

- Weak die + stressful package = early failure

- Strong die + poor thermal path = throttling

Cost impact

| Without Correlation | With Correlation |

|---|---|

| Scrap entire lots | Scrap only weak die |

| Long debug cycles | Faster root cause |

| Supplier disputes | Fact-based alignment |

Business truth

Poor correlation slows yield learning velocity.

Slow learning delays time-to-market.

Delayed launch kills margin.

As Deming said:

“Data without understanding is just noise.”

4. Stakeholder Perspectives and Decision Drivers

Description: This section explains why die vs package correlation matters differently to executives, engineers, buyers, and QA teams.

Correlation aligns teams that usually speak different languages.

- Executives: risk, margin, scalability

- Engineers: validation, debug, optimization

- Supply chain: supplier comparison, leverage

- QA & PM: lifecycle, compliance, NPI risk

A shared source of truth

When all teams see the same die-to-package map:

- Arguments turn into decisions

- Opinions turn into evidence

- Meetings get shorter

Strong companies debate less. They measure more.

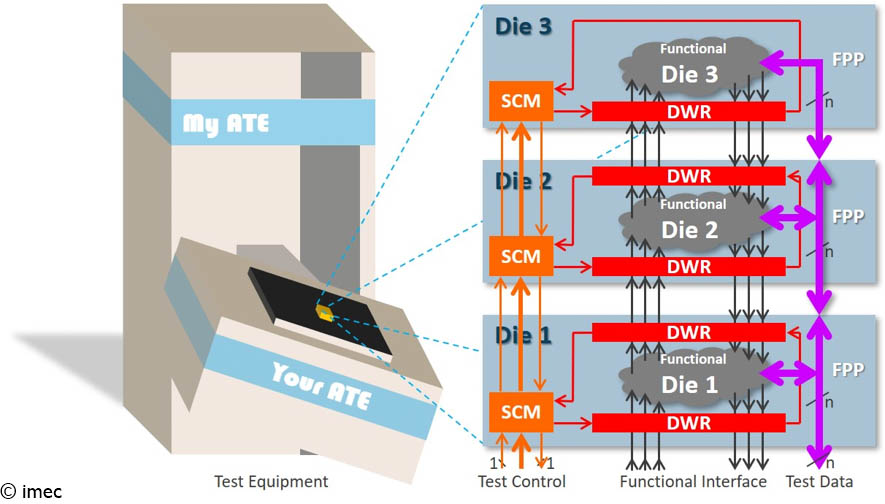

5. Traceability and Data Infrastructure Foundations

Description: This section covers the systems and traceability required to enable reliable die-to-package correlation.

Correlation fails without traceability.

Core building blocks

- Unique die ID

- Wafer-to-package mapping

- Lot, tool, and timestamp integrity

System roles

| System | Role |

|---|---|

| MES | Flow and genealogy |

| SPC | Process drift detection |

| Yield systems | Pattern discovery |

The real problem

Data exists.

Ownership does not.

Siloed systems break correlation.

Broken correlation hides risk.

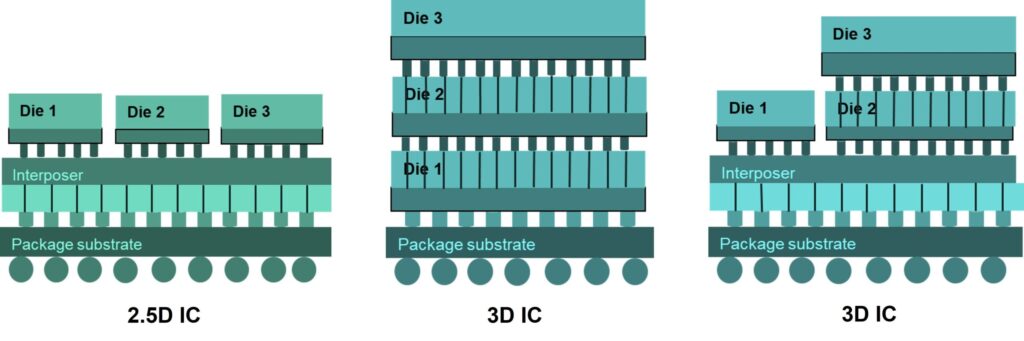

6. Correlation Granularity and Advanced Packaging Complexity

Description: This section explains how correlation becomes harder—and more valuable—as packaging complexity increases.

Single-die packages are hard enough.

Now add:

- Chiplets

- SiP

- 2.5D / 3D ICs

- Heterogeneous integration

New correlation layers

- Die-to-die interaction

- Sub-die hotspots

- TSV and interposer effects

Reality check

One bad die can kill five good ones.

Granularity matters.

Averages lie.

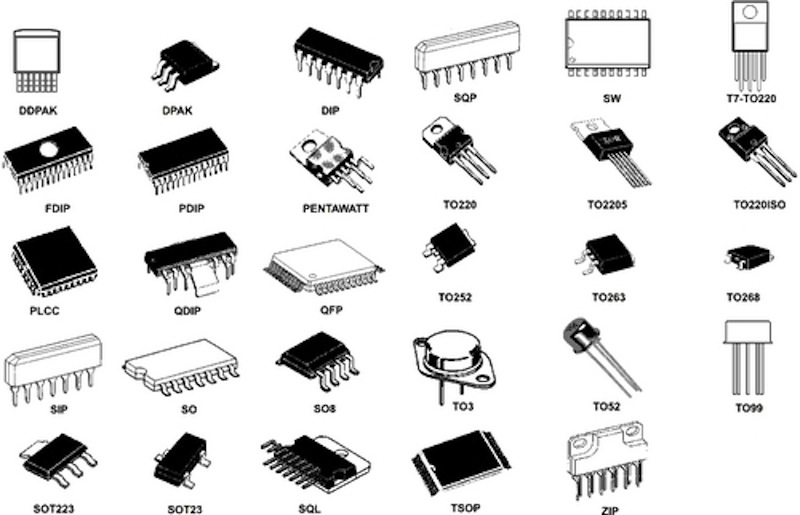

7. Packaging Technology Impact on Correlation

Description: This section shows how different package types introduce different failure modes that must be correlated back to the die.

| Package Type | Correlation Risk |

|---|---|

| QFN | Warpage, moisture |

| BGA | Solder fatigue |

| Flip-chip | Stress concentration |

| WLCSP | Limited protection |

Package-induced failures

- Thermal mismatch

- Mechanical stress

- Signal integrity loss

Sometimes packaging masks weak die.

Sometimes it amplifies variation.

Without correlation, you never know which.

8. Strategic Takeaways and Competitive Advantage

Description: This final section distills die vs package correlation into actionable strategy and future-proof advantage.

Die vs package correlation is not a tool.

It is a capability.

What leaders do differently

- Embed correlation in NPI

- Share data across partners

- Measure learning speed, not just yield

Competitive edge

- Faster ramps

- Fewer escapes

- Lower lifetime cost

As the industry saying goes:

“Yield is temporary. Learning is permanent.”

Companies that master correlation ship faster, fail less, and win more.

Final Thought

In a world of shrinking nodes and rising complexity, visibility is power.

Die vs package correlation turns scattered data into insight.

Insight into decisions.

Decisions into advantage.

And advantage into market leadership.

If you’d like, I can next:

- Add automotive or AI-specific deep dives

- Convert this into pillar + cluster content

- Optimize further for featured snippets & GEO ranking